Jumbo loans, also known as non-conforming, are typically loans where the principal balance exceeds the conforming loan limit of $417,000 that is set by Fannie Mae or Freddie Mac, although some areas have higher limits. Jumbo loans have always carried a higher interest rate than conforming loans, until recently.

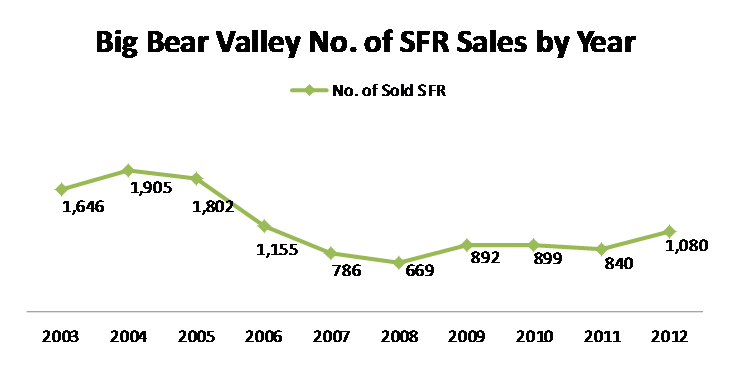

In September 2013 the interest rates for jumbo loans were lower than those of conforming loans. Major news sources have analyzed the possible reasons for this occurrence, ranging from the shift showing health and stability in the market to others stating that it is a sign of instability. One article linked the decrease in rates to an increase in the sale of high-end homes, which piqued my interest as to whether Big Bear has experienced any such increase. Since the rate decrease just occurred in September, it seems it would be premature for data to indicate a solid increase. However, I decided to look at sales in different price ranges regardless of whether they are linked to the decrease in loan rates.

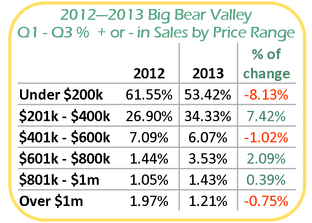

The chart to the left shows that price ranges are shifting. As you can see, sales under $200k decreased by 8.13% while there was a closely corresponding increase of 7.42% in the $201k - $400k price range, and that trend of upward redistribution continues throughout the rest of the chart. The cause of these shifts is not apparent, but I suspect it is a combination of a market driven increase in prices meeting buyers who have increased confidence in market stability which encourages them to spend a bit more to get the homes that they want.

RSS Feed

RSS Feed